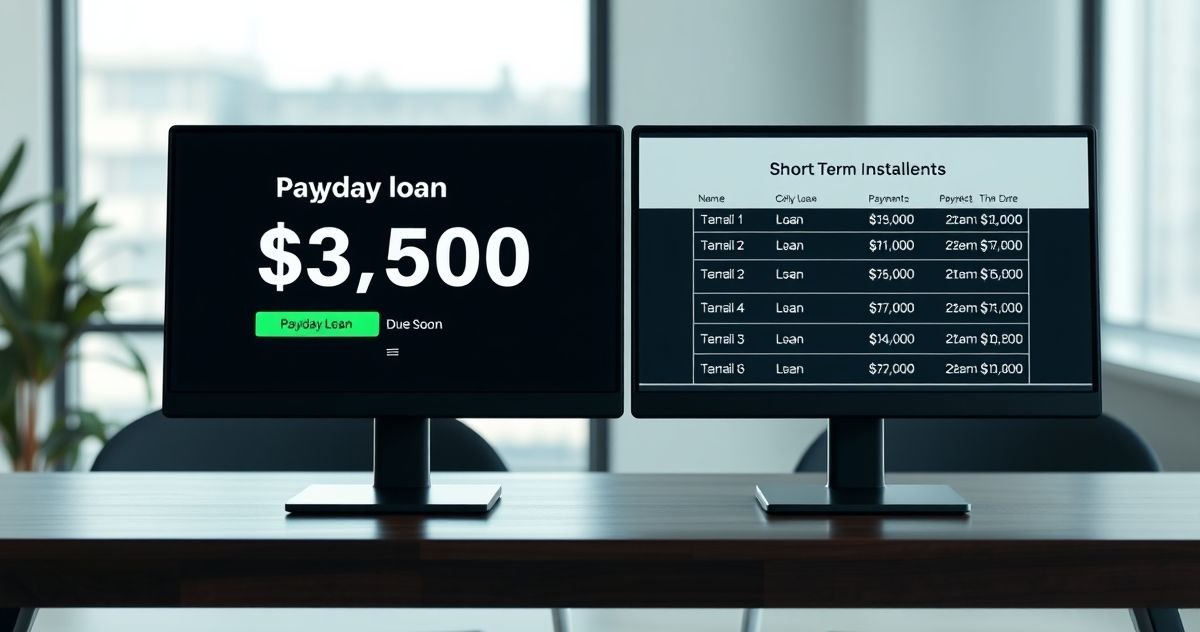

How Do Payday Loans Work?

A payday loan is a small, short-term, high-cost loan intended to be repaid on your next payday, typically within two to four weeks. Lenders generally require proof of income and access to your bank account or a post-dated check.

The primary danger is the cost. A typical fee of $15 per $100 borrowed may seem manageable, but it translates to an Annual Percentage Rate (APR) of nearly 400%. If you cannot repay the full amount on time, the lender may offer a “rollover,” where you pay another fee to extend the due date. This practice can lead to a cycle of debt, a situation the Consumer Financial Protection Bureau (CFPB) warns consumers about.

What Are Other Types of Short-Term Loans?

“Short-term loan” is a broad term for any loan with a repayment period of a year or less. Unlike payday loans, they often feature more manageable structures and costs.

- Personal Installment Loans: These loans provide a lump sum that you repay in fixed monthly payments over several months to a year. Banks, credit unions, and online lenders offer them with APRs that are significantly lower than payday loans, usually based on your credit score.

- Payday Alternative Loans (PALs): Offered exclusively by federal credit unions, PALs are a much safer alternative. According to the National Credit Union Administration (NCUA), PALs have interest rates capped at 28% and application fees capped at $20, making them a more affordable option for members.

- Lines of Credit: A line of credit gives you access to a set amount of funds, but you only borrow and pay interest on what you need. It offers more flexibility than a fixed loan.

Key Differences: Payday Loans vs. Short-Term Loans

This table highlights the crucial distinctions between predatory payday loans and more traditional short-term loan products.

| Feature | Payday Loans | Other Short-Term Loans (e.g., Personal Installment) |

|---|---|---|

| Loan Amount | Small (typically $100–$1,000) | Varies widely ($500–$5,000+) |

| Repayment | Single lump sum in 2–4 weeks | Fixed monthly installments over months or a year |

| Cost (APR) | Extremely high (often 400%+) | Lower, more competitive rates (e.g., 6%–36%) |

| Requirements | Proof of income and bank account | Often requires a credit check and income verification |

| Risk Profile | High risk of creating a debt trap | Lower risk due to structured, predictable payments |

Should You Use a Payday Loan?

Financial experts almost universally advise against using payday loans due to their predatory nature and high cost. Before considering one, explore all other options:

- Negotiate a payment plan with your creditor.

- Look into a Payday Alternative Loan (PAL) from a local credit union.

- Use a credit card for the expense, as its cash advance APR is typically far lower than a payday loan’s.

- Consider a debt consolidation loan if you’re struggling with multiple high-interest debts.

External Resources:

For more information on the risks of payday lending, visit the Consumer Financial Protection Bureau’s guide on what is a payday loan.