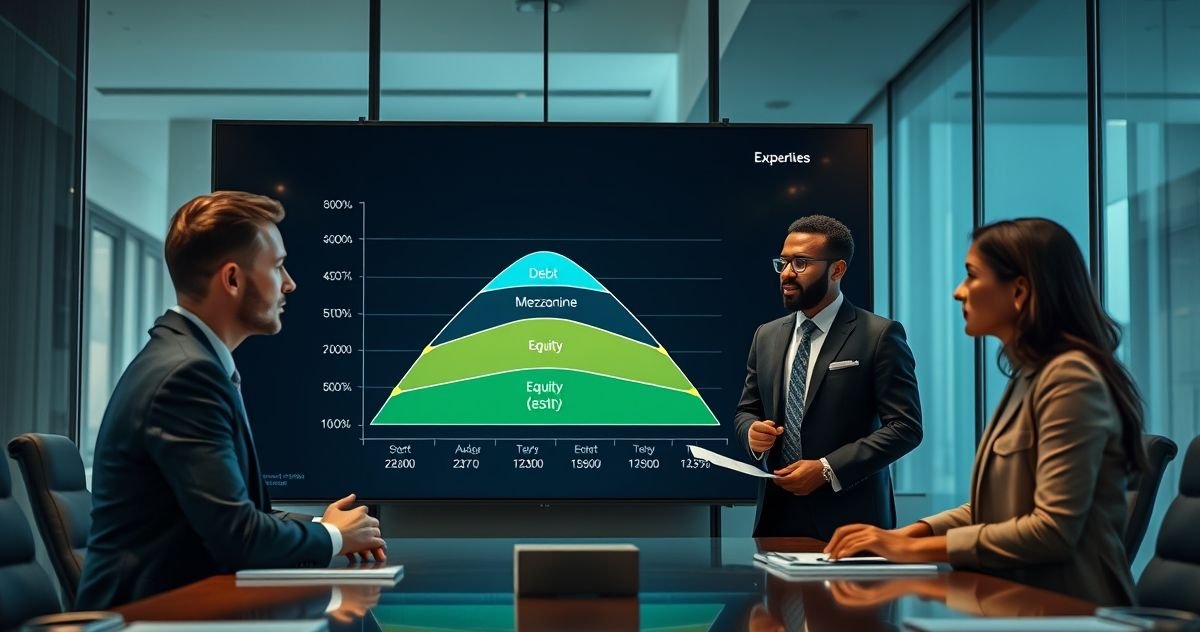

A mezzanine loan is a specialized form of financing that blends features of both debt and equity. Positioned between senior debt (like traditional bank loans) and equity in the capital structure, mezzanine loans provide companies with a flexible source of capital that can finance expansion, acquisitions, or other major projects without immediate significant equity dilution.

Typically used by established medium-to-large private companies, mezzanine loans are attractive because they offer more capital than senior lenders might permit while avoiding the direct ownership dilution that comes with issuing new shares. The term “mezzanine” refers to its intermediate position, much like the mezzanine floor in a building between ground and upper levels.

Mezzanine loans are structured as subordinated debt, which means they get repaid after senior debt in the event of default, increasing the lender’s risk. To compensate, mezzanine lenders charge higher interest rates and often receive an “equity kicker”—a feature such as warrants or conversion rights—which allows them to benefit from the company’s upside potential.

For example, a company that has exhausted its traditional bank loan options but wants to avoid diluting ownership by issuing new stock might use mezzanine financing. This lets them bridge funding gaps without giving up control immediately. However, the cost of mezzanine debt is typically higher due to its riskier nature.

Advantages of mezzanine loans include less immediate equity dilution, flexible repayment terms (like interest-only periods or deferred principal), and faster access to capital compared to equity raises. On the downside, they come with higher costs, complex negotiations, and subordinated claim status. Also, the equity kicker may eventually dilute current shareholders if exercised.

Common use cases for mezzanine loans include real estate development projects needing additional funds beyond senior loans, leveraged buyouts where private equity firms combine debt layers to finance acquisitions, and company expansions that require capital without immediate equity sales.

It’s important to understand the misconceptions about mezzanine loans. Unlike senior loans, they are often unsecured, relying on company cash flow and growth potential rather than specific collateral. Also, they differ from preferred equity, which represents ownership without a maturity date, whereas mezzanine loans must be repaid but include equity-like features.

If a borrower defaults, mezzanine lenders may convert their loans into equity stakes, potentially gaining control, or enforce repayment acceleration. This mix of debt and equity characteristics makes mezzanine loans a unique but potentially costly financing tool.

To learn more about related capital structures, you can explore our article on Senior Lien Holder Priority Rights, which explains the precedence senior debt holds over mezzanine loans in repayment.

For comprehensive, authoritative information on mezzanine financing, consider IRS guidance and resources from the Corporate Finance Institute and Investopedia.