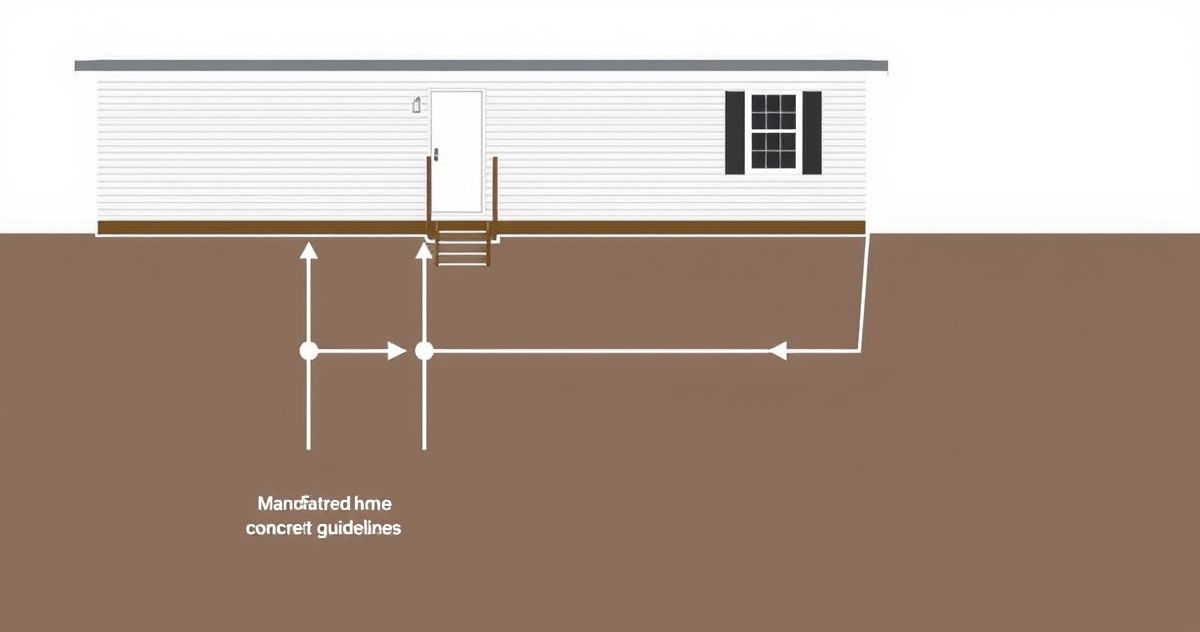

Manufactured home foundation guidelines are a set of federally established rules, mainly by the U.S. Department of Housing and Urban Development (HUD), detailing how factory-built homes must be permanently attached to the land. These guidelines are crucial because they determine a manufactured home’s classification as real property versus personal property, impacting safety and financing options.

The primary purpose of these guidelines is twofold: to provide structural stability and to meet lender requirements. A compliant permanent foundation protects the home from hazards such as strong winds, soil movement, and frost heaves. For lenders, a home permanently affixed to an approved foundation qualifies for conventional mortgage loans, often with better interest rates and terms than chattel loans, which are used when the home is considered personal property.

Key requirements include:

- Permanence: Foundations must be built from durable materials such as concrete; the crawl space beneath the home should be properly ventilated and enclosed by skirting or siding.

- Secure Anchoring: The home must be anchored using tie-downs and fasteners to transfer forces like wind and earthquakes safely into the ground.

- Removal of Mobile Elements: Wheels, axles, and towing hitches must be removed to reclassify the home as real property.

- Load Bearing: The foundation must reliably support the entire weight of the manufactured home without shifting or settling.

- Engineering Certification: A licensed structural engineer must inspect the foundation and provide a stamped certification letter confirming compliance with HUD’s Permanent Foundations Guide for Manufactured Housing (PFGMH).

Common foundation types include slab-on-grade (a reinforced concrete slab), crawl space foundations (short walls creating an accessible space under the home), and basements (full excavated spaces beneath the home, often used in colder climates).

These guidelines affect buyers, sellers, and current homeowners. Buyers need compliant foundations to secure FHA, VA, USDA, or conventional loans; sellers benefit from a certified foundation to widen their market; homeowners seeking refinancing or home equity loans will also need proof of compliance.

Avoid common mistakes such as assuming any foundation is permanent simply because the home rests on blocks, neglecting the required engineer’s certification, overlooking local building codes that may impose stricter requirements, and failing to remove the home’s wheels or hitch.

For more on financing manufactured homes, see our Manufactured Home Loan article and learn how foundation compliance ties into loan eligibility. Additional authoritative guidance is available on HUD’s Permanent Foundations Guide for Manufactured Housing.

Sources:

- Permanent Foundations Guide for Manufactured Housing (HUD.gov)

- FHA Single Family Housing Policy Handbook – Manufactured Housing (HUD.gov)

- What Is a Chattel Mortgage? (NerdWallet)