Why cash flow buckets work

Cash flow buckets tap two simple behavioral truths: people save what they don’t see, and defaults shape habits. By creating separate “buckets” for specific purposes and automating transfers, you reduce reliance on willpower and make progress predictable. In practice this means your emergency fund, targeted savings goals, and investments grow without manual transfers or last‑minute decisions.

(For government guidance on automating savings and consumer protections, see the Consumer Financial Protection Bureau (CFPB).)

A step‑by‑step setup you can apply today

- Inventory your income and timing

- List all reliable income (paychecks, predictable side income) and the date(s) they hit your bank. Note variable sources separately.

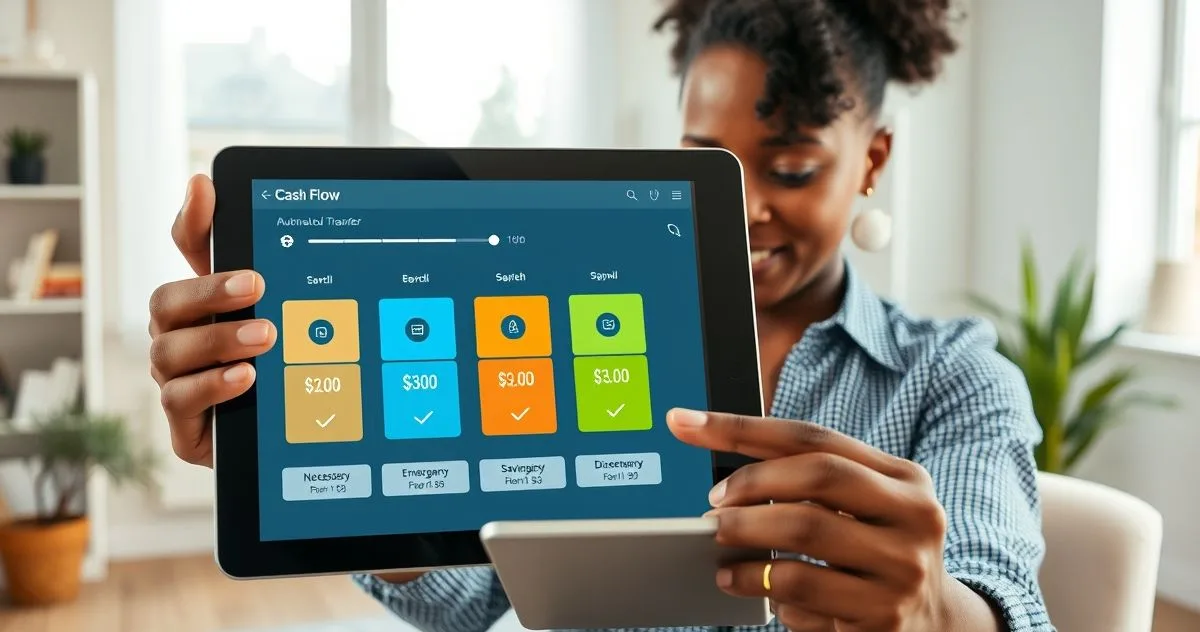

- Define your buckets (keep it simple at first)

- Necessities: rent/mortgage, utilities, groceries, insurance.

- Emergency fund: liquid cash for 3–12 months of essentials depending on your situation.

- Short‑term goals: vacation, down payment, replacement car.

- Long‑term savings & investments: retirement accounts, taxable investing.

- Spending money: day‑to‑day discretionary purchases.

- Assign target amounts or percentages

- Use a percentage model (e.g., 50/30/20 as a starting point) or flat amounts tied to bills and goals. Percentages help if income fluctuates; fixed dollar amounts work better when bills are stable.

- Choose the accounts and automation method

- Primary checking (payroll deposits and bills).

- Separate savings accounts for each bucket or subaccounts if your bank offers them.

- Automate transfers with scheduled bank transfers, split‑deposit at payroll, or an external savings app.

- Implement and monitor

- Set the transfers to happen the same day pay hits (or immediately after fixed bills are paid). Review after 30 days and again quarterly.

Automation tactics and tools

-

Direct deposit split: Many employers let you split paychecks between multiple accounts. Send fixed amounts to your emergency fund and savings account before any money hits spending checking.

-

Scheduled bank transfers: Create recurring transfers timed after payday. Most banks allow multiple rules and different frequencies per destination account.

-

Standing orders/auto transfers in online banks: Online banks and credit unions often make it easy to create named subaccounts and automatic sweeps.

-

Round‑up and goal apps: Apps that round purchases up and send the spare change to a goal account can accelerate small savings automatically. These are best used to supplement primary bucket flows.

-

Bill pay and escrow accounts: For predictable annual or semiannual bills (insurance, taxes), keep a dedicated bucket so you don’t scramble when a bill arrives.

Account architecture: separate accounts vs subaccounts

-

Separate accounts: Open a named savings account for each major bucket. This gives visual separation and makes transfers explicit. Use a high‑yield savings account for liquidity buckets (emergency, short term).

-

Subaccounts or “buckets” inside one bank: Many banks provide labeled subaccounts within a single login. This reduces friction and still delivers the psychological benefit of separation.

-

Sweep/split features: Some banks let you sweep excess checking balances into savings or invest automatically above a threshold. Use these for overflow rather than core funding if you rely on precise budgets.

Tip: Keep the emergency fund fully liquid and separate from any investment accounts. For more on why emergency funds and investment accounts shouldn’t be mixed, see our article “Why Emergency Funds Should Be Separate from Investment Accounts”.

(Internal link: Why Emergency Funds Should Be Separate from Investment Accounts)

Example allocations and how to choose one

- Conservative starter split (for building cushion): Necessities 50%, Emergency/short‑term 20%, Savings/Investing 15%, Spending 15%.

- Growth focused split (if emergency fund is already intact): Necessities 50%, Investments 30%, Spending 20%.

- Variable‑income variant: Cover fixed costs first with a baseline bucket, then divide remaining expected income across savings buckets by percentage. Hold a “buffer” bucket for months with less income.

Concrete example: If you receive $4,000 on the 1st of each month, and fixed bills are $2,000, you can set transfers so $2,000 stays in checking for bills, $800 goes to an emergency fund, $600 to retirement/tax‑advantaged accounts, and $600 to a travel/special goal bucket. Automating these transfers keeps them from getting spent.

Handling variable income

-

Prioritize fixed costs and an operating buffer. After those are covered, allocate variable income by percentage.

-

Build a “smoothing” bucket (also called buffer or operating bucket) equal to 1–2 pay periods of expenses. Use it to cover months with lower inflows.

-

Pay yourself first on every paycheck: even small automatic transfers (e.g., 1–5% per check) compound into meaningful balances over time.

For more on designing cash flow plans when income varies, see our guide on comprehensive cash flow mapping: Comprehensive Cash Flow Mapping for Personal Financial Plans.

Monitoring, rebalancing, and reporting

-

Review quarterly: Adjust percentages as your life changes (new job, child, mortgage). Rebalance buckets when goals are met or priorities shift.

-

Use a single monthly reconciliation: A simple spreadsheet or budgeting app that reads all accounts helps you confirm transfers occurred and buckets are on track.

-

Maintain a cadence: quick weekly check (10 minutes) for activity, deeper monthly reconciliation (30–60 minutes), and strategy review quarterly.

Common mistakes and how to avoid them

-

Overcomplicating buckets: Too many micro‑buckets increase maintenance. Start with 4–6 and add only when a new goal is persistent.

-

Underfunding necessities: If your necessities bucket is too small, you’ll trigger overdrafts or tap savings. Reconcile actual bills against your target allocation and correct.

-

Using investments as emergency liquidity: Keep emergency cash separate and liquid. Long‑term investments can lose value when you need them.

-

Forgetting taxes and irregular bills: Create a tax/annual bills bucket if you’re self‑employed or have predictable yearly expenses.

Security, FDIC, and tax notes

-

FDIC protection: If you use multiple banks, ensure account ownership and bank-level FDIC limits are clear (typically $250,000 per depositor, per insured bank, per ownership category).

-

Tax treatment: Contributions to tax‑advantaged buckets (IRA, 401(k)) follow IRS rules. Automated transfers to taxable savings or brokerage accounts do not change tax status. Consult IRS guidance or a tax professional for specifics.

-

Consumer protections: When automating transfers, check your bank’s policies on recurring transfers and dispute rights. The CFPB provides consumer guidance on using automatic payment tools (Consumer Financial Protection Bureau).

Real‑world wins and pitfalls (practical examples)

-

Emergency fund growth: One household I worked with converted a temptation‑driven spend habit into an automatic $500/month emergency bucket. Over a year their liquid cushion exceeded $6,000 and they avoided high‑interest credit on a car repair.

-

Goal‑oriented saving: Another client split payroll so $150 per pay went to a travel bucket; within 10 months they hit their $3,000 goal without adjusting lifestyle choices.

-

Pitfall case: A client created eight tiny buckets and lost track. We consolidated into four buckets and scheduled a monthly reconciliation — the simplified system stuck.

Tools and banks to consider

- Employer payroll split (ask HR/Payroll).

- Your primary bank’s split‑deposit and scheduled transfer features.

- High‑yield savings accounts for emergency/short‑term buckets.

- Apps that provide labeled goals, round‑ups, and automatic rules.

Quick checklist to launch this week

- Choose 4–6 buckets and name them.

- Decide percentages or fixed dollar amounts.

- Set up split direct deposit or scheduled transfers timed with payday.

- Create a monitoring habit: 10‑minute weekly check and 30‑minute monthly reconciliation.

- Revisit allocations quarterly.

Further reading and internal resources

- Using forecasts to maintain liquidity: Using Cash Flow Forecasts to Maintain Your Emergency Cushion

- Why emergency funds should be separate: Why Emergency Funds Should Be Separate from Investment Accounts

Professional disclaimer

This article is educational and not individualized financial advice. In my experience working with clients, cash flow buckets are a practical tool to make saving automatic, but you should consult a financial advisor or tax professional for recommendations tailored to your situation.

Sources and guidance

- Consumer Financial Protection Bureau (ConsumerFinance.gov) — guidance on saving and automatic transfers.

- Federal Deposit Insurance Corporation — FDIC insurance basics.

- Internal Revenue Service — rules for tax‑advantaged accounts.