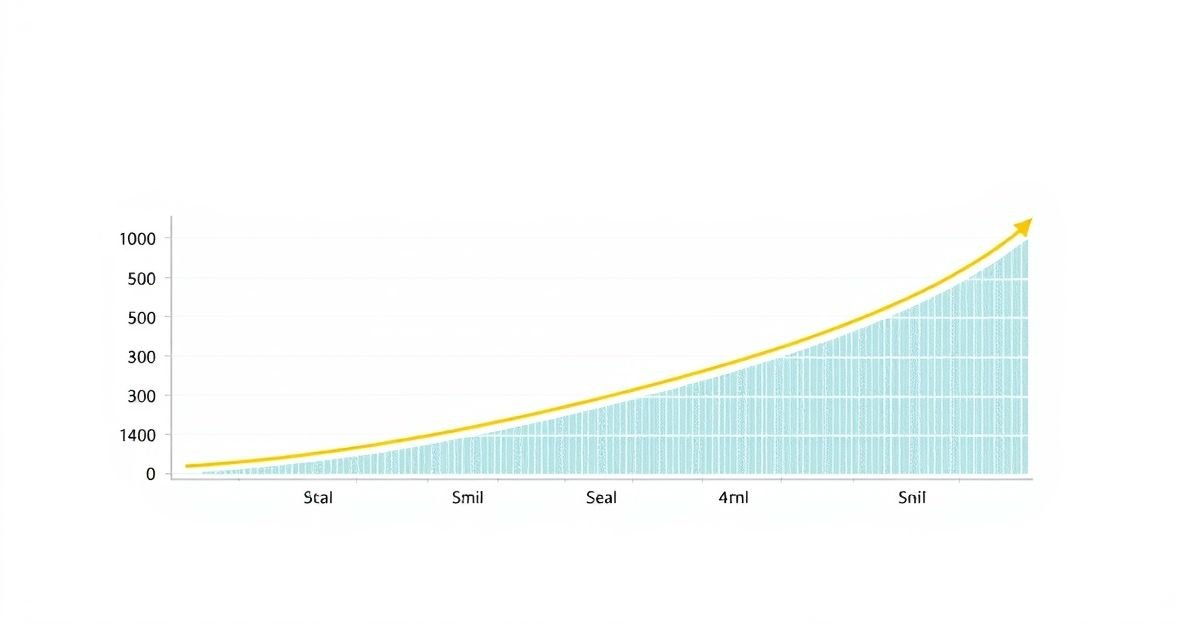

A Graduated Payment Adjustment Schedule is designed to ease the repayment burden on borrowers in the early years of a loan when income may be lower or unstable. Typically, this repayment plan starts with monthly payments below what a traditional fixed-payment loan would require. These payments then increase by a specific percentage—often annually—over a period like 5 to 10 years until reaching a stable, fixed monthly amount for the remainder of the loan term.

This approach is commonly used in certain mortgage products, known as Graduated Payment Mortgages (GPMs), which were popular for first-time buyers or younger borrowers anticipating a rise in income. However, GPMs have become rare due to risks like negative amortization, where initial low payments do not cover all the interest accrued, causing the principal loan balance to grow temporarily. For more on GPMs, see our detailed Graduated Payment Mortgage (GPM) guide.

Similarly, some federal student loan repayment plans, such as Income-Based Repayment (IBR) or Pay As You Earn (PAYE), provide payment increases linked to income growth rather than a preset schedule. These income-driven plans offer flexibility based on your earnings and family size, though they are different from traditional graduated payment schedules. Learn more about these options in our article on Income-Based Repayment.

Key benefits of graduated payment schedules include lower initial payments aligned with early career or business startup income levels, easing qualification for loans. However, borrowers should weigh these against potential downsides like higher total interest costs and the risk of payment shocks if income growth does not meet expectations.

If considering a loan with this schedule, carefully project your income trajectory and understand how early payment amounts affect principal balance and interest. Prepaying principal when possible can reduce interest and loan duration. Additionally, building an emergency fund is advisable to manage potential increases in payment obligations.

For comprehensive loan repayment options and strategies, visit our Repayment Schedule Options page.

For authoritative details on federal student loan repayment plans, refer to the U.S. Department of Education’s Income-Driven Repayment Plans.

Understanding the structure, risks, and benefits of a Graduated Payment Adjustment Schedule can help you select a repayment plan that matches your financial situation and future earning potential.