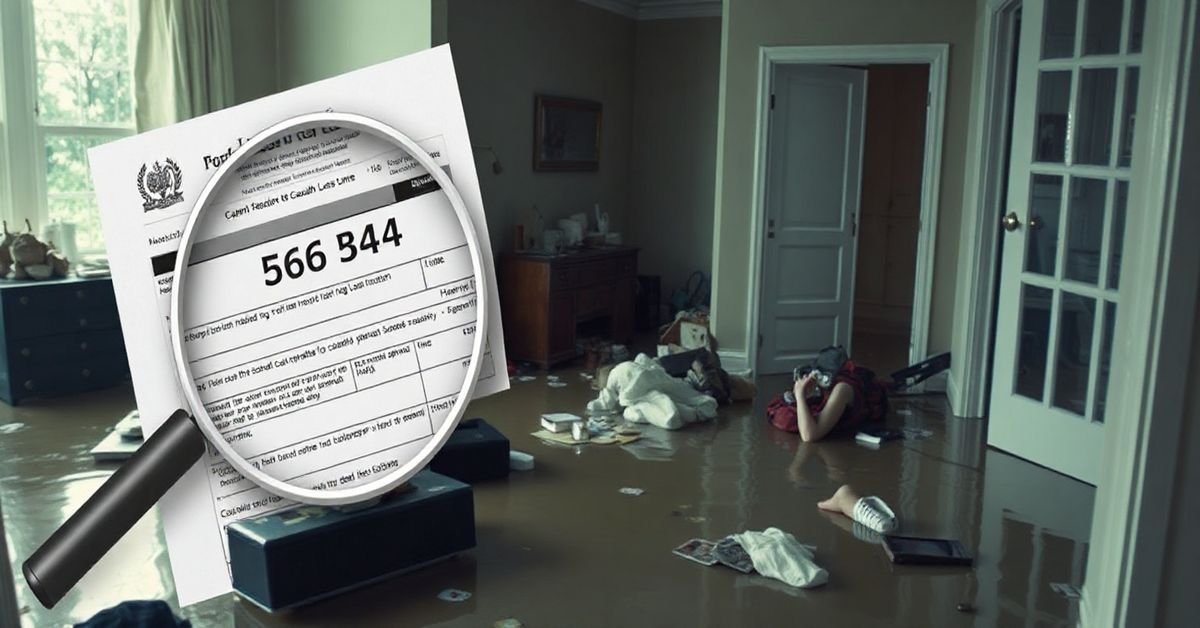

Understanding Form 4684: Your Guide to Casualty and Theft Losses

It’s never fun to experience a loss, especially from a disaster, accident, or theft. The good news is that the IRS offers some relief in the form of tax deductions. This is where Form 4684 comes in. This form helps you calculate and claim deductions for these types of losses. Let’s break it down and see how it applies, particularly when you’ve experienced a disaster.

What is a Casualty Loss?

A casualty loss, in tax terms, is damage, destruction, or loss of property resulting from a sudden, unexpected, or unusual event. Think of things like:

- Natural disasters: Hurricanes, earthquakes, floods, wildfires, tornadoes.

- Accidents: Car accidents, house fires, or other unexpected mishaps.

- Vandalism: Damage done intentionally by others.

What is a Theft Loss?

A theft loss, on the other hand, involves the unlawful taking of your property. It’s essential to differentiate a theft from simply losing something. It needs to be an actual illegal act. This could be a burglary, robbery, or embezzlement of funds or assets.

Form 4684: The Reporting Tool

Form 4684 is the official IRS form you use to calculate and report these casualty and theft losses on your tax return. It guides you through figuring out how much of your loss is deductible. You’ll need it to take any qualifying tax breaks related to these unfortunate events.

How Does Form 4684 Work?

The form is pretty straightforward, but let’s walk through the basic process:

-

Identify the Loss: First, you need to figure out if your situation qualifies as a casualty or theft loss. We’ve covered some examples above.

-

Determine the Basis of Your Property: This basically refers to how much you paid for the property or what its original cost was.

-

Calculate the Decrease in Fair Market Value: Next, you’ll determine how much the property’s value dropped because of the event. This is usually done by comparing the value before and after the incident. You’ll likely need documentation and potentially professional appraisals to support this.

-

Calculate Your Deductible Loss: This is where the actual Form 4684 comes into play. The form has specific calculations that consider the lesser of your basis or the decrease in fair market value. You’ll also have to reduce the deductible amount by any insurance reimbursements you received and by $100 per loss.

-

Apply Limitations: There are limitations on how much of your casualty losses you can deduct, especially on personal property. Generally, for most situations, the total loss must exceed 10% of your adjusted gross income (AGI). This threshold can be altered for disaster areas.

-

Special Rules for Disaster Areas: If you live in a federally declared disaster area, things can get a little different (and often more advantageous). You might have relaxed limitations, or special elections, meaning you might be able to take more of the deduction. This includes the ability to claim casualty losses in the tax year prior to the disaster by filling the form as a disaster loss.

Who Is Affected by Form 4684?

Form 4684 affects a wide range of people who have experienced property loss:

- Homeowners: If your home was damaged by a hurricane or fire, you’ll likely need Form 4684.

- Renters: Renters can also use Form 4684 if their personal property was damaged in their rented space.

- Business Owners: If your business property suffered a loss, you can use it, although the process is slightly different than for personal property.

- Individuals with Theft Losses: If you experienced a theft, you’ll need to report it on this form as well.

Disaster-Related Claims: A Closer Look

When it comes to natural disasters, the rules surrounding casualty losses can become more complex but also more beneficial. Here are some things to be aware of:

-

Federally Declared Disaster Areas: These are areas that the federal government has identified as eligible for federal aid after a major event. If your loss occurred in one of these areas, the deduction limitations can be more favorable.

-

Optional Deduction for Disaster Losses: If your loss occurred in a federally declared disaster area, you have two choices. You can take a deduction in the year the loss occurred, or, you can elect to take it in the immediately prior tax year. This can sometimes give you a greater benefit.

-

Increased AGI Threshold: For disaster-related losses, Congress often raises (or sometimes removes) the 10% AGI threshold, making it easier for you to deduct more of your loss.

-

Insurance Matters: Remember, insurance payments reduce the amount of your deductible loss. Form 4684 will walk you through calculating this. You have to report any reimbursements.

Related Concepts and Terms

- Adjusted Gross Income (AGI): Your gross income minus certain deductions. This is a key factor in calculating your deductible casualty loss.

- Fair Market Value (FMV): The price at which your property would sell in the open market. Important when assessing loss amounts.

- Basis: Your original cost of an asset, which can affect your tax liability.

- Insurance Reimbursements: Payments you receive from your insurance company to cover losses.

- Federally Declared Disaster: An event that qualifies for government support and allows for increased casualty loss deductions.

Tips and Strategies for Using Form 4684

- Document Everything: Keep records of your purchase prices, receipts, appraisals, photos, and police reports. These can be crucial when filing your claim.

- Get Professional Help: A tax professional can help you navigate the intricacies of Form 4684, particularly if you’ve experienced a large or complicated loss or are dealing with the aftermath of a natural disaster.

- Assess Your Loss Accurately: The key is to value the property before and after the event. Take accurate, itemized notes, as well as pictures.

- Understand Insurance: Know your insurance coverage and what it includes. The reimbursement amount will reduce your claimable tax deduction.

- Be Aware of Time Limits: There are deadlines for claiming your losses, so be sure to file on time, or claim it in an amended return if you discover it later.

Common Mistakes and Misconceptions

- Thinking Any Loss is Deductible: Not all property losses qualify. They must meet the criteria of being “sudden, unexpected, or unusual.”

- Claiming Losses When There is No Theft or Casualty: Losing something doesn’t mean you can claim it under Form 4684.

- Not Documenting Your Losses Thoroughly: Without proper documentation, the IRS may not allow your claim.

- Ignoring Insurance Reimbursements: These must be considered when calculating your deductible loss.

- Overestimating the Loss: Overinflating the decrease in property value can lead to tax penalties.

- Assuming Disaster Status Automatically Removes All Restrictions: Even if you’re in a disaster area, you must still go through the process of calculating your loss on the form.

The Importance of Form 4684

Form 4684 can be a lifesaver when you’ve experienced a devastating loss from a disaster or theft. It’s there to help you recover financially by offering a tax deduction that can help alleviate some of the hardship. Take the time to understand this form and keep all of your documentation, and you will be on the right path to claiming a valuable deduction. If you aren’t sure, don’t hesitate to seek assistance from a tax professional.