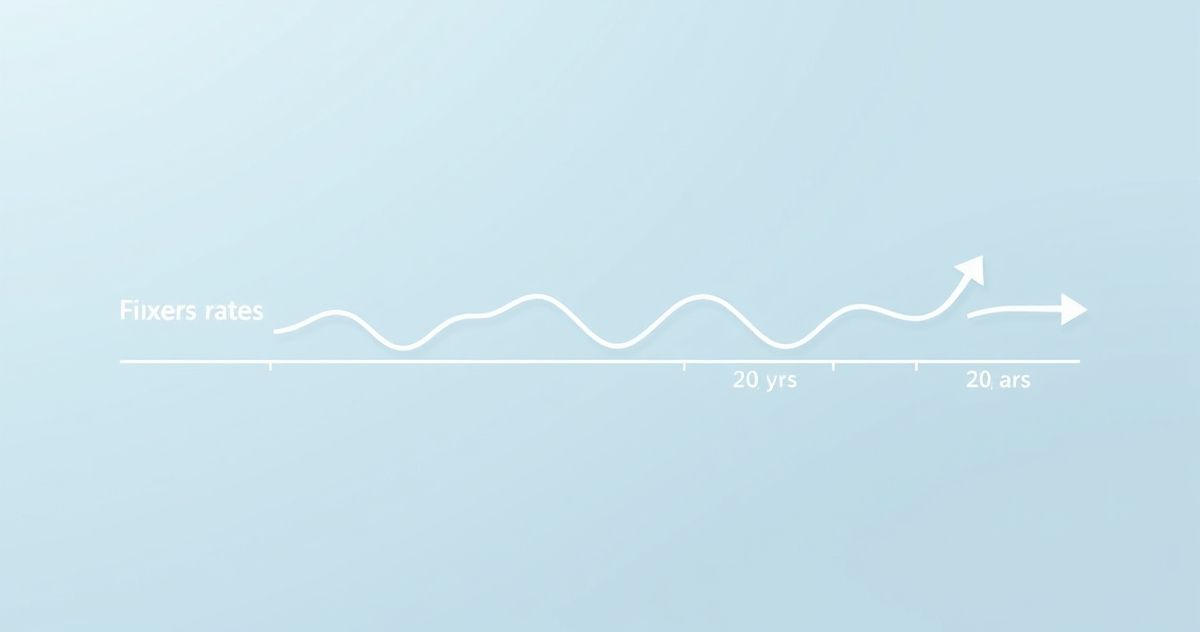

A 5-year ARM (Adjustable-Rate Mortgage) is a hybrid home loan combining stability and flexibility. For the first five years, it offers a locked-in fixed interest rate, typically lower than comparable fixed-rate mortgages, allowing for consistent monthly payments. After this fixed period, the loan enters an adjustable-rate phase where the interest rate resets periodically—commonly annually or semi-annually—based on a specified financial index plus a fixed margin set by the lender. For example, if the loan uses the Secured Overnight Financing Rate (SOFR) as the index and your margin is 2.5%, your adjusted rate equals SOFR plus 2.5%.

The 5-year ARM is often described as a “5/1 ARM” or “5/6 ARM.” In a 5/1 ARM, the rate adjusts once each year after the initial five years, while a 5/6 ARM adjusts every six months. These adjustment frequencies affect how often your payment amount can change.

To limit sudden increases, 5-year ARMs include rate caps defined in three ways: an initial adjustment cap limiting the rate increase at the first reset, a subsequent adjustment cap capping future annual increases, and a lifetime cap that sets the maximum rate over the loan term. For example, a 2% initial cap means your rate cannot rise more than two percentage points at the first adjustment.

This mortgage suits buyers planning to move within five years, expecting income growth, or intending to refinance before the rate adjusts. While ARMs once had a reputation for risk, modern regulations and built-in protections make them a valuable option in the right circumstances. To compare, see our article on Fixed-Rate vs ARM Comparison and learn more about the Adjustable-Rate Mortgage (ARM) basics. Additionally, understanding the Margin (ARM Loan) and relevant Rate Index topics can deepen your grasp of how ARMs function.

For more comprehensive details on refinancing options, you can visit our Mortgage Refinance guide.

Sources:

- Consumer Financial Protection Bureau, What is an adjustable-rate mortgage (ARM)? https://www.consumerfinance.gov/ask-cfpb/what-is-an-adjustable-rate-mortgage-arm-en-1995/

- Investopedia, 5/1 ARM: What It Is, How It Works, Pros & Cons https://www.investopedia.com/terms/5/5-1_arm.asp

- NerdWallet, What Is a 5/1 ARM? https://www.nerdwallet.com/article/mortgages/5-1-arm-mortgage