Key Points:

- Emergency Fund vs. Strategic Asset: An emergency fund is a personal finance necessity based on stability and peace of mind, not an investment decision. Cash held beyond this can be a strategic part of a portfolio.

- The “Sleep-at-Night” Factor: The ideal size of an emergency fund (whether 3, 6, or 12 months of expenses) ultimately depends on an individual’s risk tolerance, income stability, and comfort level.

- The Trade-Off of Holding Cash: While a small strategic cash allocation (e.g., 10%) doesn’t drastically harm long-term returns, it can provide an emotional hedge and a buffer against market volatility.

- Strategic vs. Tactical: There’s a major difference between a disciplined, strategic allocation to cash that is periodically rebalanced and trying to tactically time the market based on fear, which often leads to poor outcomes.

- Record Cash on the Sidelines: Over $7 trillion is currently held in money market funds, a significant increase from pre-pandemic levels, indicating widespread investor apprehension.

In a financial landscape where markets seem to consistently climb, investors are grappling with a persistent and challenging question: Is it time to raise some cash? The temptation to de-risk is palpable, especially with headlines fueling uncertainty. However, the decision to move assets into cash is not a simple one and involves navigating the delicate balance between financial security and investment growth.

Differentiating The Emergency Fund from Investment Cash

First and foremost, it’s crucial to distinguish between an emergency fund and cash held as a strategic portfolio allocation. An emergency fund is a cornerstone of personal finance, not an investment. Its purpose is to provide a safety net against life’s unexpected turns.

How Big Should Your Emergency Fund Be?

The common rule of thumb suggests holding 3-6 months’ worth of living expenses. However, this is merely a guideline. The right amount depends on a variety of personal factors:

- Income Stability: Someone with a variable income or in a high-risk career might opt for a larger fund of 9-12 months.

- Access to Credit: The availability of other liquid funds, like a home equity line of credit (HELOC) or a brokerage account, can influence the size of the cash reserve needed.

- Peace of Mind: Ultimately, the most important variable is the “sleep-at-night” factor. The fund should be large enough to make you feel secure, regardless of market conditions.

Cash as a Strategic Asset in Your Portfolio

Beyond the emergency fund, holding cash can be a deliberate strategic choice within an investment portfolio. This isn’t about panic-selling; it’s about incorporating cash as a tool for managing risk and opportunity. Investors might hold a higher cash allocation to be opportunistic during market downturns, to fund withdrawals without selling stocks at a loss, or simply as a shock absorber against volatility.

Understanding the Performance Trade-Off

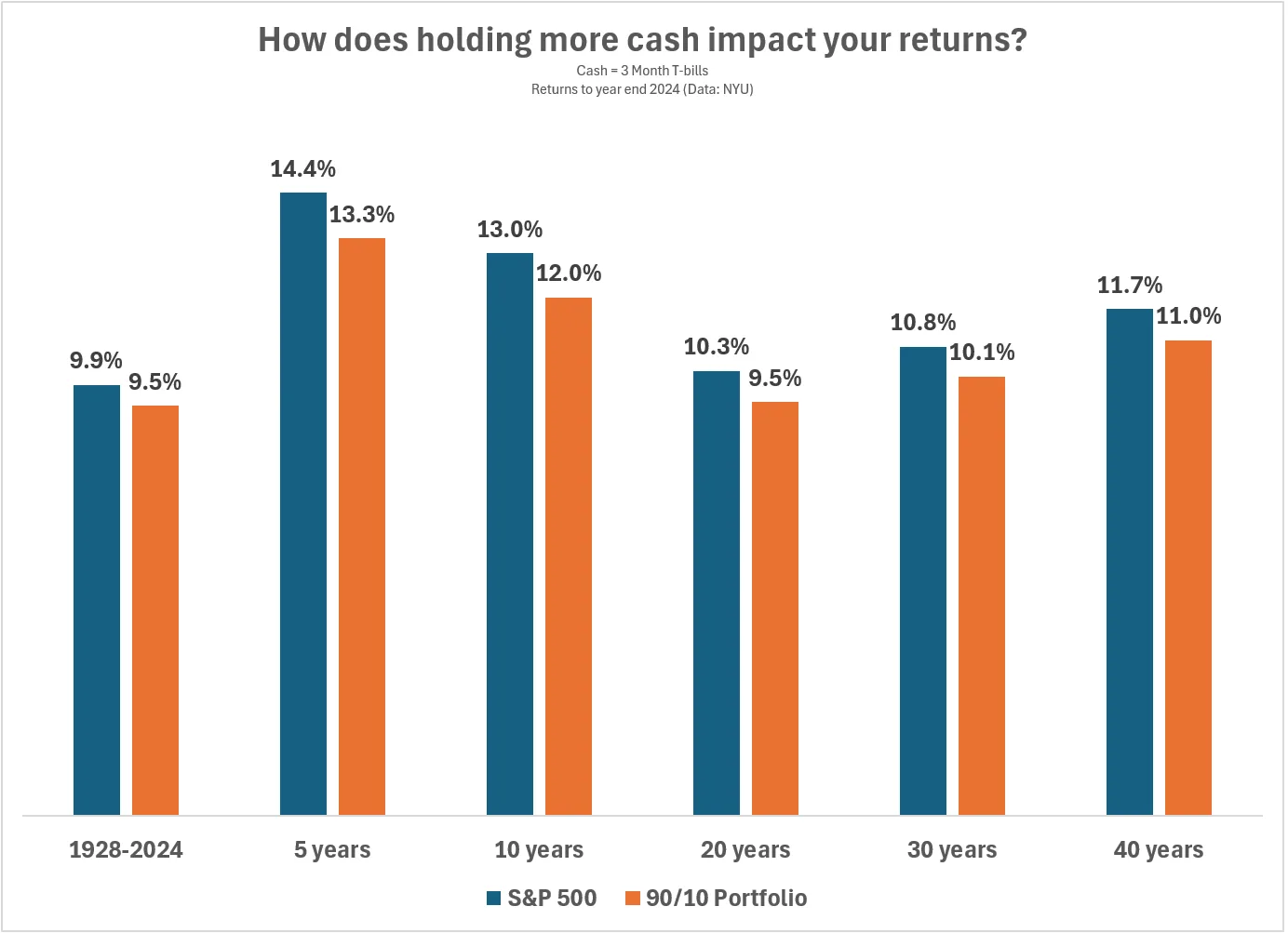

The primary drawback of cash is its long-term performance; it rarely keeps pace with inflation, meaning its purchasing power erodes over time. However, holding a modest strategic allocation to cash doesn’t have to decimate your returns.

Analysis comparing a 100% S&P 500 portfolio to a 90% stock and 10% cash portfolio shows that the difference in annual returns is not as massive as one might think. For many, the slight reduction in potential gains is a worthwhile price for reduced volatility and the emotional comfort that cash provides.

The Danger of Market Timing

The current financial climate has led to a surge in cash holdings. Data reveals that over $7 trillion is now sitting in money market funds alone, a staggering increase from roughly $3 trillion before the pandemic. While this reflects a cautious sentiment, it also highlights the risk of investors attempting to time the market.

Investing based on feelings is a notoriously poor strategy. There is a vast difference between a disciplined, strategic allocation that is part of a long-term plan and tactically trying to guess when to pull money out and when to put it back in. The latter is a guessing game that even professionals struggle to win. A repeatable process and a set of established rules are far more likely to lead to long-term success.

In a recent episode of “Ask the Compound,” this very topic was discussed, providing further insights into managing cash, diversifying assets, and other pressing financial questions.

Ultimately, the decision to hold cash requires a clear understanding of its purpose. Whether it’s for emergencies or as a strategic hedge, the choice should be rooted in a well-defined plan, not a reaction to market noise.

Image Referance: https://awealthofcommonsense.com/2025/09/is-it-time-to-raise-some-cash/