Tax law is vital to the functioning of government and the economy, determining how individuals and businesses contribute to public finances. The legislative process for creating tax laws in the U.S. is deliberate and constitutionally mandated, ensuring checks, debates, and adjustments before laws take effect.

Background and Constitutional Basis

Under Article I, Section 7 of the U.S. Constitution, known as the “Origination Clause,” all bills for raising revenue must originate in the House of Representatives. This rule places the House at the center of the tax lawmaking process. Over time, tax law has evolved to address economic complexities, social priorities, and policy goals.

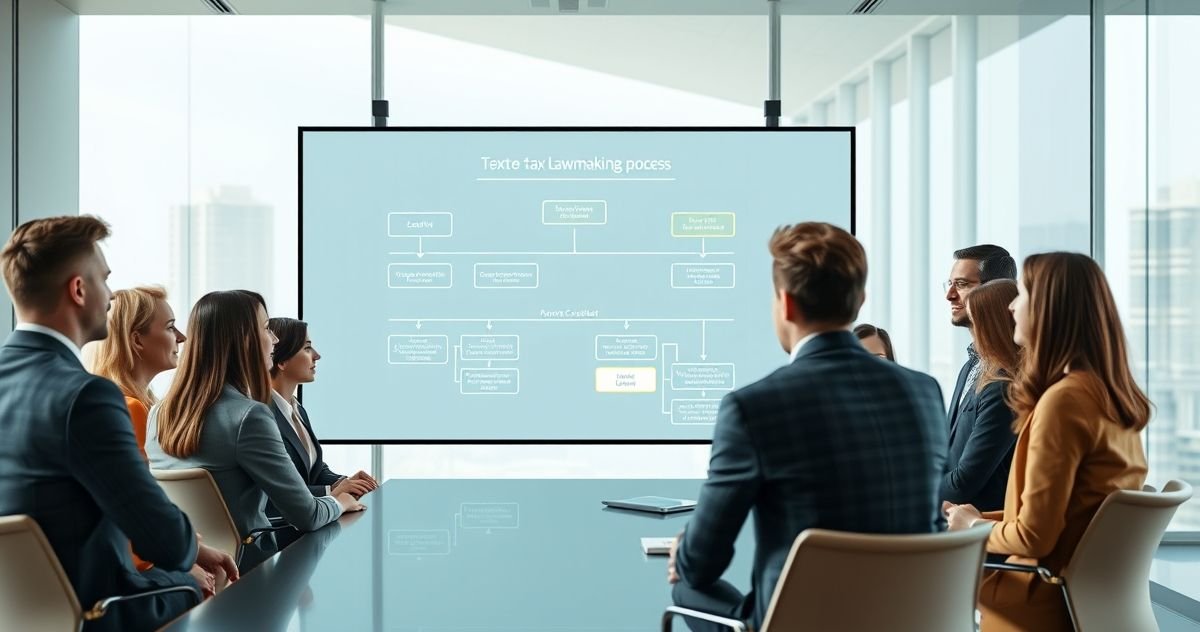

Step-by-Step Process of Making Tax Law

- Idea Generation and Legislative Proposal

Tax law often starts with an idea from various sources:

- Congress Members: Elected officials propose changes reflecting constituent needs or policy goals.

- Executive Branch: The President and Treasury Department recommend tax proposals based on economic policy.

- Interest Groups and Lobbyists: Organizations advocate for tax measures that favor their interests.

- Economic Conditions and Public Opinion: Events like recessions or inflation drive demand for tax reforms.

Once an idea is formed, it is drafted into a formal bill.

-

Introduction in the House of Representatives

The tax bill must be introduced by a House member and receive a bill number (e.g., H.R. 1). -

House Committee on Ways and Means Review

The bill goes to the Ways and Means Committee, the principal tax committee in the House.

- Hearings: Experts and stakeholders provide testimony.

- Markup Sessions: Committee members debate, amend, and revise the bill.

- Committee Vote: Approval forwards the bill to the full House.

-

House Floor Debate and Vote

The bill is scheduled for debate under rules set by the House Rules Committee. Floor debate allows further amendments before a majority vote decides passage. -

Senate Consideration

The Senate receives the bill and refers it to the Senate Finance Committee.

- The committee reviews the bill through hearings and markups.

- The Senate debates the bill on the floor; unlike the House, debate can be prolonged by filibusters requiring 60 votes to end.

- The Senate may pass, amend, or reject the bill.

-

Conference Committee Reconciliation

If the Senate amends the bill, a conference committee of House and Senate members reconciles differences to produce a unified version. -

Final Congressional Approval

Both chambers must approve the conference report without further changes. -

Presidential Action

The President can sign the bill into law, veto it, or take no action. A veto can be overridden by a two-thirds congressional vote. No action within 10 days while Congress is in session results in the bill becoming law; if Congress adjourns, the bill dies (pocket veto). -

Codification and Implementation

Once enacted, tax laws are incorporated into the Internal Revenue Code (Title 26 U.S. Code). The Treasury Department and the IRS issue regulations and guidance to enforce the law.

Real-World Examples

- Tax Cuts and Jobs Act of 2017: Initiated by the Trump administration, this major tax reform lowered rates and altered deductions after extensive committee work and conference negotiations.

- Affordable Care Act Tax Provisions (2010): Included taxes to help fund healthcare reforms and followed the legislative process detailed above.

Who Is Affected?

Tax laws impact:

- Individuals: Affecting income tax rates, deductions, and credits.

- Businesses: Influencing corporate taxes, credits, and depreciation rules.

- Nonprofits: Governing tax-exempt statuses and related regulations.

Staying Informed and Prepared

- Follow trusted news and tax resources.

- Consult tax professionals like CPAs or Enrolled Agents.

- Check official sites such as IRS.gov and Congress.gov for up-to-date information.

- Review tax withholdings after law changes to avoid surprises.

Common Misunderstandings

- Tax laws are complex; not just simple increases or cuts.

- The President proposes but cannot unilaterally change tax laws.

- Small changes can affect different taxpayers in varied ways.

FAQs

Can tax laws be retroactive? Occasionally, but usually for immediate relief or corrections. Retroactive increases are rare.

How long does it take for a tax bill to become law? Timeframes vary from weeks to years based on complexity and political climate.

What if a tax law is unclear? The Treasury and IRS issue clarifying regulations. Taxpayers can seek professional advice or IRS rulings.

For more detailed explanations on tax legislation and related topics, see our glossary entries on How Federal Tax Laws Are Made and Tax Legislation.